1

Exclusive: US' NSA infiltrates China's telecom infrastructure in attack on leading Chinese aviation university

*US launches cyberattacks targeting China's space and aviation university. Cartoon: Vitaly Podvitski

During the cyberattack against the email system of Northwestern Polytechnical University in China's Shaanxi Province - well-known for its aviation, aerospace and navigation studies - the US' National Security Agency (NSA) was found to have constructed a "legal" channel for remote access to the core data network of some infrastructure operators so that the US' intelligence agency could infiltrate and control the country's infrastructure, the Global Times learned from a source on Thursday.

On June 22, Northwestern Polytechnical University announced that hackers from abroad were caught sending phishing emails with Trojan horse programs to teachers and students at the university, attempting to steal their data and personal information.

A police statement released by the Beilin Public Security Bureau in Xi'an the next day said that the attack attempted to lure teachers and students into clicking links of phishing emails with Trojan horse programs, with themes involving scientific evaluation, thesis defense and information on foreign travel, so as to obtain their email login details.

To probe into the attack, China's National Computer Virus Emergency Response Center and internet security company 360 jointly formed a technical team to conduct a comprehensive technical analysis of the case.

By extracting many trojans samples from internet terminals of Northwestern Polytechnical University, under the support of European and South Asian partners, the technical team initially identified that the cyberattack to the university was conducted by the Tailored Access Operations (TAO) (Code S32) under the Data Reconnaissance Bureau (Code S3) of the Information Department (Code S) of US' NSA.

Aiming at Northwestern Polytechnical University, TAO used 41 types of weapons to steal the core technology data including key network equipment configuration, network management data, and core operational data. The technical team discovered more than 1,100 attack links infiltrated inside the university and more than 90 operating instruction sequences, which stole multiple network device configuration files, and other types of logs and key files, the source said.

According to analysis of characteristics of TAO attack, infiltration tools and Trojan horse samples, the technical team also found that TAO has infiltrated some infrastructure operator in China, built a "legal" channel for remote access to the core data network, and attempted to controlled China's infrastructure.

More details about TAO's cyberattack on Northwestern Polytechnical University will be released soon, the source said.

Media Source: Global Times

2

Risky moves take a heavy toll on Taiwan

The strained cross-Straits relations have dealt a blow to the Economic Cooperation Framework Agreement between the two sides of the Taiwan Straits and, as a result, the prospects for Taiwan's economy appear dim.

According to statistics from Taiwan, cross-Straits trade accounted for 33 percent of the Chinese island's total external trade last year, compared with 28.6 percent in 2011. In the first quarter of this year alone, cross-Straits trade reached $165.24 billion, up 9.5 percent year-on-year. Such growth may not be possible if cross-Straits ties remain strained.

To boost cross-Straits trade and spur the economic growth of Taiwan, the Chinese mainland's efforts alone are not enough. The island authorities too have to show sincerity and make efforts to deepen cross-Straits economic and trade cooperation. And if the island authorities do not do so, the innocent Taiwan residents will suffer.

The mainland has always attached great importance to Taiwan's economic growth and mutually beneficial trade across the Straits.

Triggered by US House Speaker Nancy Pelosi's reckless visit to Taiwan on Aug 2, the present cross-Straits crisis is the most serious since the military standoff across the Straits in 1995-96. Yet for the good of both sides of the Straits, the mainland does not want a military conflict, although it will not desist from using force to reunify the island with the motherland.

The two economies across the Straits are highly complementary. The mainland provides Taiwan with abundant factors of production and a vast market, and Taiwan, as a global leader in chip manufacturing, has helped boost the high-tech industries on the mainland. So a stable cross-Straits environment is needed to deepen economic and trade cooperation between the two sides and achieve win-win results.

That's why despite the high tensions across the Straits, Ma Xiaoguang, a spokesman for the Taiwan Affairs Office of the State Council, said the mainland will, as always, warmly welcome and support Taiwan compatriots to come to the motherland to work or do business, and protect all their legitimate rights and interests. The mainland remains committed to meeting the needs of Taiwan compatriots and advancing the peaceful and integrated development of both sides of the Straits.

The root cause of the cross-Straits crisis is the United States' interference in the Taiwan question, which is an internal matter of China. Indeed, the mainland and the island both are victims of the US' design, which includes continuing arms sales to the island.

What's worse, the Senate Foreign Relations Committee approved the Taiwan Policy Act (TPA) on Sept 14, which is described as "the most comprehensive restructuring of US policy toward Taiwan since the Taiwan Relations Act of 1979." The TPA seeks to provide $4.5 billion in security assistance to Taiwan over four years, and recognize China's Taiwan as a "major non-NATO ally" of the United States.

The huge amounts Taiwan has been spending to buy weapons from the US have been a drag on the island's economy. And the fact that the US continues to sell arms to the island shows it doesn't give two hoots about Taiwan's economic development.

In the 1982 Sino-US Joint Communique on the Establishment of Diplomatic Relations between Beijing and Washington, the US pledged to reduce arms sales to Taiwan by 20 percent each year, which means it should have stopped selling arms to the island in 1988. True, US arms sales to Taiwan decreased from $800 million in 1983 to $470 million in 1991, but Washington has been providing Taiwan with technical military support and advanced weapons and equipment. And by purchasing advanced arms and equipment worth $20 billion, Taiwan had upgraded its weaponry by the 1990s.

Moreover, US arms sales, including advanced weapons and sophisticated technology, have been growing in the 21st century. In fact, according to US arms exports data, Taiwan is among the top buyers of US arms. Worse, the 2023 budget the Taiwan authorities passed on Aug 25 includes a record high military budget of about $19.17 billion, an increase of 13.9 percent from this year.

Although Beijing seeks peaceful reunification, it will not rule out the option of force to achieve that goal.

After the national reunification, countries and regions can continue to trade with Taiwan. As a matter of fact, their trade and business dealings will be smoother because many obstacles that have long held Taiwan's economy back will be removed through the integrated development of the two sides across the Straits.

As a white paper titled "The Taiwan Question and China's Reunification in the New Era" issued on Aug 10 said, the reunification will greatly boost cross-Straits economic cooperation, create more room for Taiwan's development, enhance its competitiveness, stabilize its industry and supply chains, and inject dynamism into its economy.

The two sides of the Straits must and should be reunified, because that is the call of history.

The author is head of the Institute of Taiwan Economics, Central University of Finance and Economics.

The views don't necessarily represent those of China Daily.

Media Source: China Daily

3

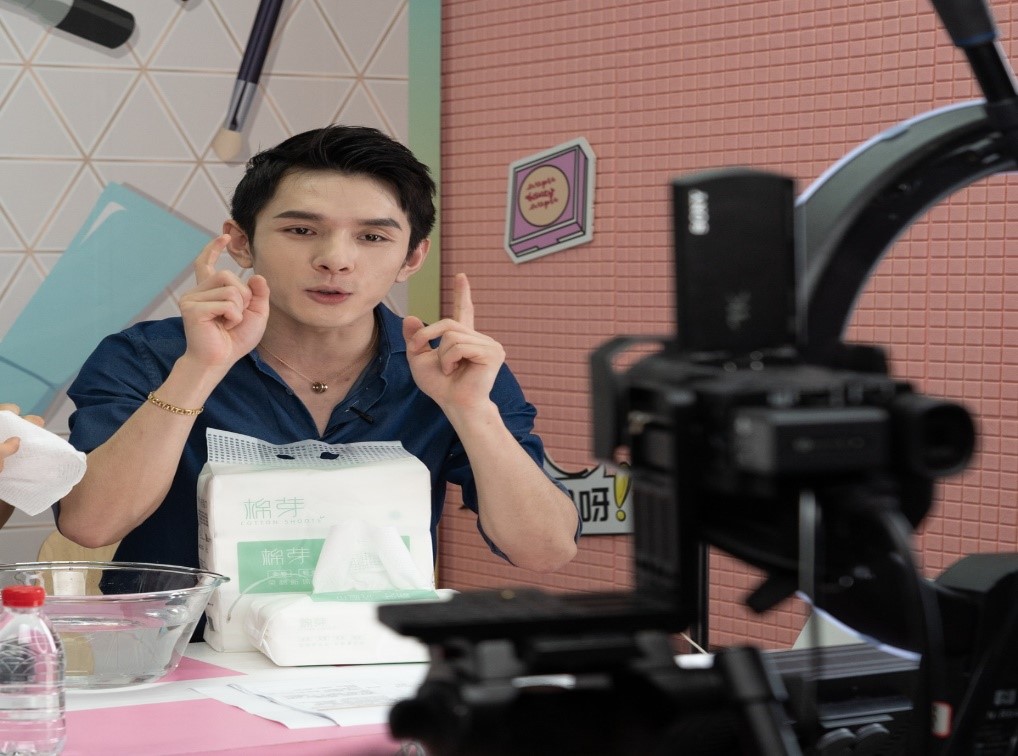

Lipstick king' back, jumpstarts online sales

After being absent from the public eye for over three months, Li Jiaqi, a top livestreaming host also known as the "lipstick king", returned to e-commerce behemoth Alibaba Group's livestreaming platform on Tuesday, which industry experts said is expected to bolster online consumption and intensify competition in the burgeoning e-commerce livestreaming segment.

Li's livestreaming session on Taobao Live, which kicked off at 7 pm, attracted 150,000 viewers in the first 10 minutes and this figure surpassed 22 million by 8 pm. He showcased a number of commodities like cosmetics, skincare products, apparel and other household goods during the two-hour livestreaming session, with viewer numbers ultimately numbering 62.31 million.

Most of the products Li promoted sold out immediately as viewers flooded the screen with comments welcoming him back, while the top livestreaming sales influencer repeatedly asked his audience to "shop rationally".

Experts said the landscape of Chinese e-commerce livestreaming industry had begun changing during Li's absence.

Dong Yuhui, a 29-year-old livestreamer from education training company New Oriental, has become a big hit by selling agricultural products in both Chinese and English through livestreaming. He quickly garnered over 20 million followers within just 20 days in June.

Oriental Selection, the livestreaming channel of New Oriental on short video platform Douyin, had raked in over 300 million yuan ($42.6 million) during this year's June 18 shopping carnival, which ran from June 1 to 18.

"Livestreaming has become a key method widely adopted by consumer brands to retain existing users, attract new ones and boost sales revenue," said Cui Lili, director of the Institute of E-commerce at Shanghai University of Finance and Economics.

A batch of new anchors represented by Dong from New Oriental, which features a refreshing style that combines disseminating knowledge and selling goods at the same time, has gained increasing popularity among the younger generation and is expected to break the monopoly of one or two top-notch influencers in the e-commerce livestreaming sector, Cui said.

According to market consultancy iiMedia research, the revenue of China's e-commerce livestreaming sector amounted to 1.2 trillion yuan in 2021, up 25 percent year-on-year, and the figure is projected to reach 2.1 trillion yuan in 2025.

Mo Daiqing, a senior analyst at the Internet Economy Institute, said Li's comeback on his livestreaming channel might be a test for the upcoming "Double-11"-the Singles Day shopping festival on Nov 11.

"No one wants to miss the biggest annual promotion campaign initiated by e-commerce platforms," Mo said, adding that given Li's popularity among consumers, his return will boost sales on Alibaba's online marketplaces.

Competition in the livestreaming e-commerce sector is set to intensify as an increasing number of brands and merchants are flocking to livestreaming rooms of short video platforms including Douyin, Kuaishou and Xiaohongshu-a lifestyle-focused social networking site, she said.

Online retailers should make strategic adjustments to reduce their dependence on top livestreaming anchors and support new anchors, she added. Moreover, more and more brands are aggressively moving toward starting their own livestreaming activities.

Media Source: China Daily

4

China's central bank injects 21b yuan into market through reverse repos to ensure stable liquidity

The People's Bank of China (PBC), the country's central bank, on Wednesday conducted reverse repurchase operations to inject a total of 21 billion yuan ($2.98 billion) into the market, in a bid to maintain stable liquidity in the banking system at the end of the quarter.

The operations included 2 billion yuan of seven-day reverse repos at an interest rate of 2 percent, and 19 billion yuan of 14-day reverse repos at an interest rate of 2.15 percent, according to a statement on the website of the PBC.

It was the third consecutive day that the central bank carried out reverse repos. It conducted 26 billion yuan of reverse repos on Tuesday and 12 billion yuan on Monday.

Market liquidity has been rather tight recently due to several factors, as some debts of local financing platforms are approaching maturity and China's exports have grown more slowly recently, Sun Lijian, director of the Financial Research Center at Fudan University in Shanghai, told the Global Times on Wednesday.

China's exports stood at $314.9 billion in August, up 7.1 percent year-on-year, 10.9 percentage points slower than the pace in the previous month, according to data from the General Administration of Customs.

The PBC's reverse repos show that the central bank has maintained an independent stance to stabilize liquidity levels so as to support the economic recovery, despite a growing air of panic in global financial markets ahead of a possible interest rate hike on Wednesday (US time) by the US Federal Reserve, an analyst said.

Against the backdrop of the US and many other major economies tightening liquidity, the PBC's move showed that China has been able to stick to its own rhythm and meet the needs of its own economic development, even though the hawkish Fed policy is mounting pressure on the markets, Sun said.

Behind these independent steps, Sun cited China's resilient economic fundamentals and the nation's effective foreign exchange management. Unlike the situation in some countries in Southeast Asian and East Asian countries, China has seen no massive withdrawal of foreign capital so far, Sun noted.

While the yuan has weakened against the surging US dollar recently and China's stock market has dropped as some foreign capital left the market, the overall scale remained small, he added.

The central parity rate of the yuan weakened 68 basis points to 6.9536 against the US dollar on Wednesday, according to the China Foreign Exchange Trade System.

China's A-share market closed lower on Wednesday, with the Shanghai Composite Index down by 0.17 percent, the Shenzhen Component Index down by 0.67 percent and the ChiNext Index (Growth Enterprise Market Index) losing 1.49 percent.

The amount of "Northbound capital" - foreign money flowing into China's A-share market through Hong Kong - saw a net outflow of 3.06 billion yuan on Wednesday. Still, it recorded a 4.32-billion-yuan net inflow in the most recent 30 trading days.

Despite mounting pressure, the stock market hasn't seen any massive withdrawal of foreign capital, and data on direct investment in China by overseas investors showed no intention to leave the market, Sun added.

China's actual use of foreign capital rose 20.2 percent year-on-year in US dollar terms to $138.41 billion from January to August, with investments from South Korea, Germany, and Japan leading the way, data from the Ministry of Commerce showed on Monday.

"All these developments have made space for China to roll out monetary policies based on its own needs, instead of outside pressure," Sun said.

Media Source: Global Times